“Hotels, pipelines, convenience stores and automaker bonds are among the assets being bought by some of the world’s biggest asset managers as they look for value in a world thrown into turmoil by the coronavirus pandemic.” – by David Ramli, Suzy Waite and Matthew Burgess

Covid-19

Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

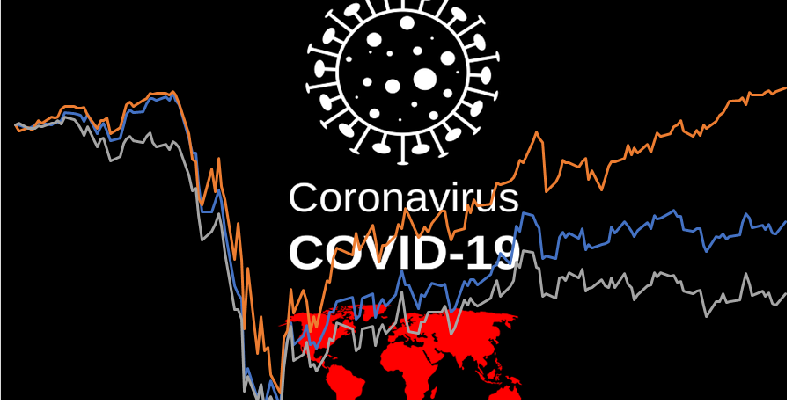

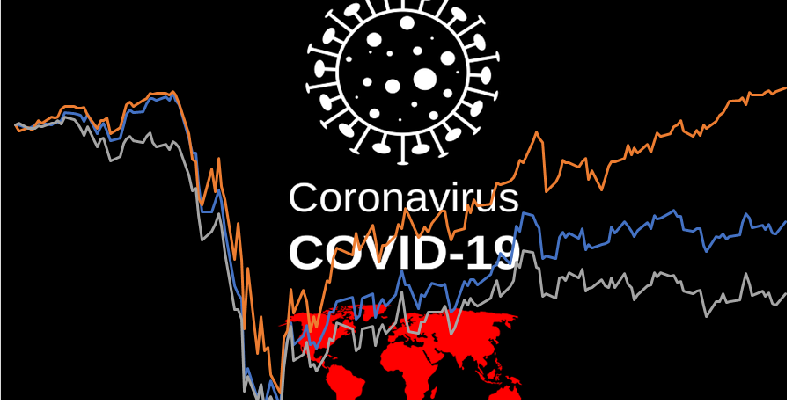

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak […]

Summer 2020 Economic Forecast: An even deeper recession with wider divergences (European Commission)

“The Summer 2020 Economic Forecast projects that the euro area economy will contract by 8.7% in 2020 and grow by 6.1% in 2021. The EU economy is forecast to contract by 8.3% in 2020 and grow by 5.8% in 2021. The contraction in 2020 is, therefore, projected to be significantly greater than the 7.7% projected for […]

The Appeal Of Investing In Banks Is Very Strong (The Corner)

“If we assume there will be no break-up of the euro, and that banks will not need significant capital hikes, the appetite for investment is very strong. Average revaluation expectations are close to 100% within a 1-2 year period.” – by Ofelia Marín-Lozano

A new credit cycle ushers in fresh class of European NPLs (GlobalCapital)

“Just when it looked as though the European NPL tide was at last beginning to fall, 14 years on from the start of the great financial crisis, a new surge of NPLs is on the horizon. It’s time to launch the securitization lifeboats.” – by Tom Brown

First European CLOs Fail Key Test Amid Strain of Pandemic Impact (Bloomberg)

“Cracks have appeared in the defenses of European collateralized loan obligations for the first time since the last financial crisis as portfolios buckle under the strain of the coronavirus pandemic.” – by Sarah Husband

How will COVID-19 impact Brexit? (Bruegel)

“Talks have been delayed, the negotiators themselves have been sick and policymakers have needed to give their full attention to fighting the virus. Nevertheless, the U.K. continues to insist it will not ask for or accept an extension in June, the current deadline for establishing such measures. As a result, European politics is back to its […]

Leveraged loan downgrades continue threat to Europe’s CLO investor base (S&P Global)

“A credit rating downgrade wave of historical proportions is following in the wake of economic disruption caused by COVID-19.” – by David Cox

France lifts lid on gradual virus deconfinement plan (Euractiv)

“Prime Minister Edouard Philippe unveiled, in a speech to MPs before the National Assembly, the outlines of the country’s deconfinement plan, which is due to begin on 11 May.” – by Cécile Barbière and Daniel Eck

Greece unveils plan to loosen lockdown (Ekathimerini)

“The plan will unfold in three phases – from May 4 to mid-June – and, depending on the data, it will change accordingly.”