“The deal between the U.K. and the EU is the largest bilateral trade pact in history, the two sides said on Thursday. It is also the first modern trade deal to disintegrate a trading partnership, erecting and defining barriers between markets. The deal, which covers a collective market worth $905 billion as of 2019, has […]

EU

Intesa, Nordea, ING, BNP Paribas most affected by ECB dividend limits (S&P Global)

“The European Central Bank has lifted its blanket recommendation against distributions, including dividends and share buybacks, but under strict conditions that will have the biggest impact on eurozone banks with high capital returns, analysts said.” – by Vanya Damyanova

The Closing Window for Angela Merkel and Joe Biden (Carnegie Europe)

“Come January 2021, the United States and Germany will have to move quickly to resolve big differences, notably over China and Russia. At stake is the strength of transatlantic ties between America and Europe.” – by Judy Dempsey

Q3 GDP up by 12.5% in the Euro Area (Eurostat)

“In the third quarter of 2020, seasonally adjusted GDP increased by 12.5% in the euro area and by 11.5% in the EU compared with the previous quarter, according to an estimate published by Eurostat, the statistical office of the European Union.” – News Release from Eurostat

EU given green light to hit US with tariffs in Airbus-Boeing ruling (FT)

“The EU has been handed the right to hit almost $4bn-worth of US goods with punitive tariffs in retaliation for illegal state aid to Boeing, leading Brussels to ramp up calls for a final settlement to the two sides’ 16-year aircraft dispute.” – by Jim Brunsden, Peggy Hollinger and Aime Williams

Finding value in EMEA (PEWire)

“For private market investors, one of the ways to consider unlocking value is to see what is happening in Europe’s renewable energy sector, which ties in closely to the European Green Deal; an ambitious initiative that aims to transition the EU to a low-carbon economy.”

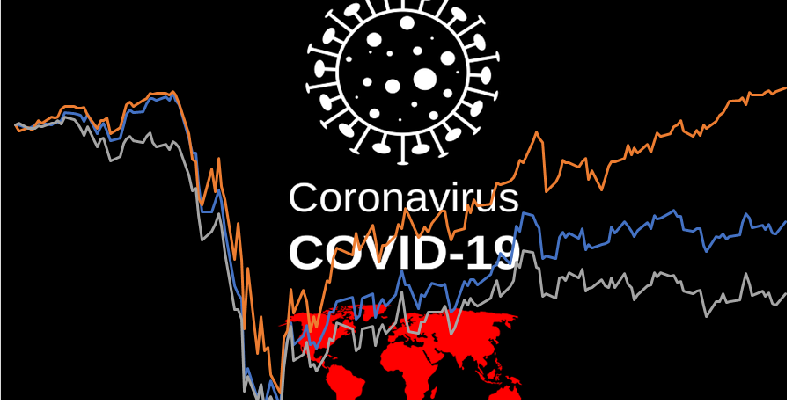

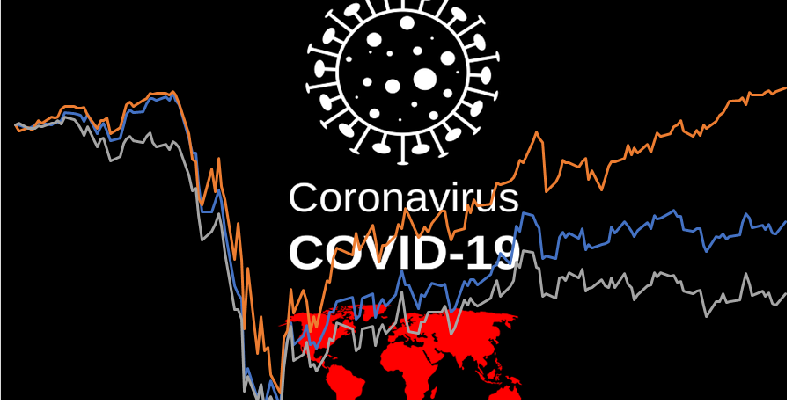

Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak […]

U.S. Cranks Up Tariff Heat on France, Germany in Airbus Dispute (Bloomberg)

“The U.S. stepped up pressure on Germany and France with extra tariffs on some of their goods, a move designed to squeeze the European Union into settling a long-running dispute over illegal subsidies to Airbus SE.” – by Brendan Murray and Jenny Leonard

Europe Looks to Loosen ‘Overly Burdensome’ Rules on Sell-Side Research (Institutional Investor)

“New amendments to MiFID would ease restrictions related to fixed income and small- and mid-cap companies.”- by Amy Whyte

EU leaders strike deal on recovery fund after marathon summit (FT)

“EU leaders have struck a deal on a landmark coronavirus recovery package that will involve the European Commission undertaking mass borrowing for the first time.” – by Sam Fleming, Jim Brunsden and Mehreen Khan