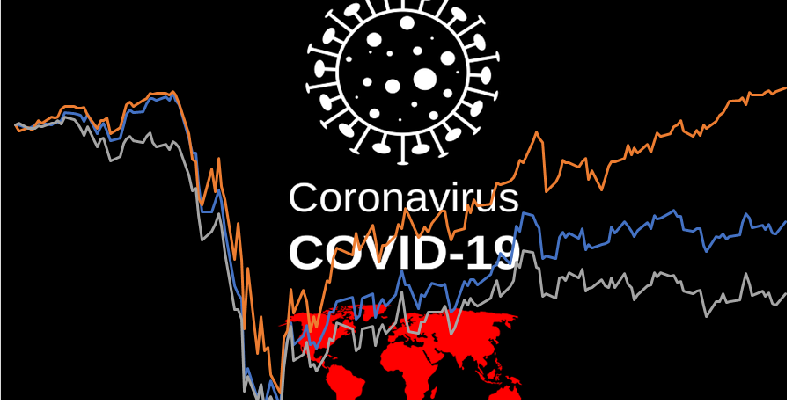

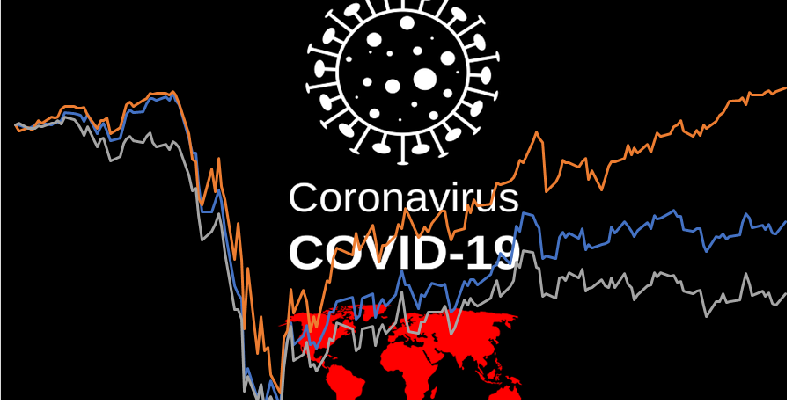

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak […]

France

Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

U.S. Hedge funds face heightened enforcement risk in France (GBFR)

“U.S. hedge funds should anticipate heightened regulatory scrutiny and enforcement risk in France. ” – by Freshfields

France lifts lid on gradual virus deconfinement plan (Euractiv)

“Prime Minister Edouard Philippe unveiled, in a speech to MPs before the National Assembly, the outlines of the country’s deconfinement plan, which is due to begin on 11 May.” – by Cécile Barbière and Daniel Eck

France injects billions into stimulus plan amid coronavirus chaos (Politico)

“PARIS – France is trying to avoid an economic catastrophe by injecting billions into its coronavirus-hit economy.” – by Elisa Braun

Investing in Europe in 2020 – The Year Ahead

An overview of some European key themes and political risks for 2020

2020 brings with it the 10th year of recovery since the global financial crisis. Equity markets continue to break records, ample credit is available, yet the bullish performance appears cosmetic at times and investing in Europe in 2020 is fraught with political risks. The US deficit doubled from $385bn to $779bn last year, the UK […]

Activist investors lay down challenge to corporate France (FT)

“Paris establishment grapples with how to respond as bigger companies become targets.” – by David Keohane and Harriet Agnew

Navigating Europe in 2019

Themes and Risks Investors in Europe to Consider in 2019

We are nearly 20 years into the new millennium and it is an unrecognizable place compared to when it started. Lehman is gone, Bear Stearns – gone, Merrill Lynch – acquired, Citigroup is a fraction of its former self. Blockbuster, Toys R Us, Woolworths are all part of the history books now. Europe, where we […]

Casino’s Woes Pit Holders of Complex Bonds Against Muddy Waters (Bloomberg)

UniCredit SpA and Societe Generale SA are among banks that issued around $107 million of structured notes in total last month tied to the embattled French grocer — the most on record

Scholz echoes French call for EU defense to cut US dependency (Handelsblatt)

“German Finance Minister Olaf Scholz , [while] visiting his French counterpart Bruno Le Maire, urged a consolidation of Europe’s defense industry to make the European Union less dependent on US suppliers.”