“The deal between the U.K. and the EU is the largest bilateral trade pact in history, the two sides said on Thursday. It is also the first modern trade deal to disintegrate a trading partnership, erecting and defining barriers between markets. The deal, which covers a collective market worth $905 billion as of 2019, has […]

UK

Sunak warns of ‘economic emergency’ as borrowing hits record £394bn (Financial Times)

“The government’s independent forecaster said the virus was responsible for an 11.3 per cent contraction in the UK economy, the steepest for more than 300 years. It added that output would take a further large hit if ministers fail to negotiate a free trade agreement with the EU before the end of the year.” – […]

No 10 toughens takeover laws to lock out ‘back door’ security risks (FT)

“The tough measures will require prospective foreign buyers of UK companies, shareholdings or intellectual property in 17 sensitive industries to alert a new government unit about proposed transactions.” – by Jim Pickard, Helen Warrell and Daniel Thomas

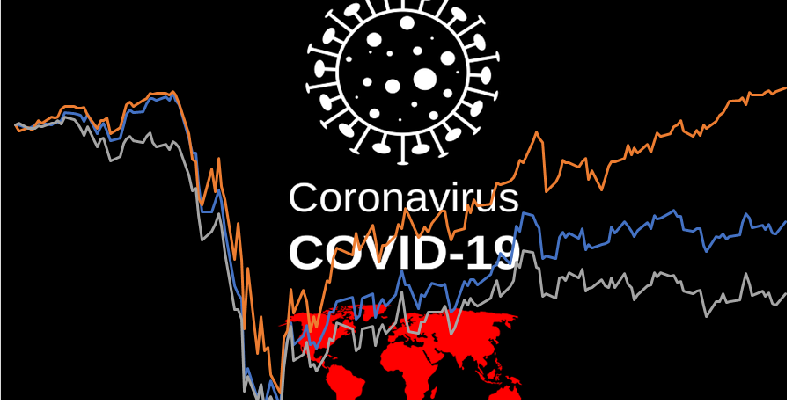

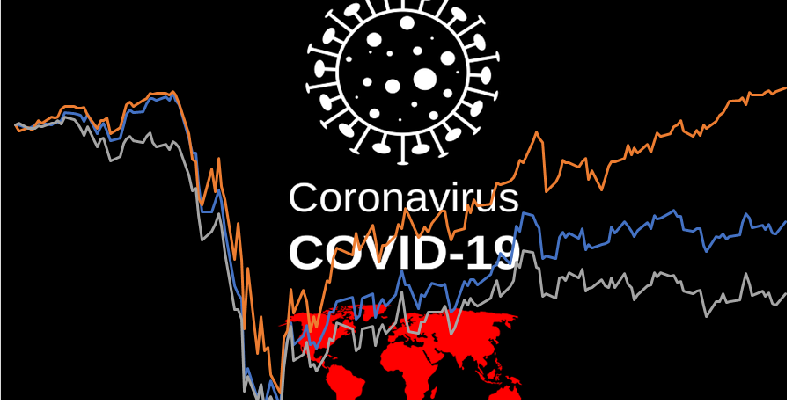

Investors in Europe: 2020 Coronavirus Update

Investors in Europe: 2020 Coronavirus Update

Lockdowns across Europe have resulted in unprecedented economic damage over the first half of 2020. Eurozone GDP fell 12% in the 2nd quarter of 2020 following a 4% contraction in Q1.

When the novel Coronavirus (COVID-19) initially struck Wuhan, China in January 2020, most investors in Europe did not expect the disease to reach the continent. Yet here we are; a seemingly innocuous holiday stop in the French Alps by a Brit returning home from a conference in Singapore has morphed into a full-scale virus outbreak […]

Britain’s banks brace for $22 billion loan losses as outlook darkens (Reuters)

“All five UK banks have under-performed, falling by between 42% and 55% this year compared to a 36% fall in the European banking index .SX7P.” – by Iain Withers and Lawrence White

LIBOR: entering the endgame – speech by Andrew Bailey (Bank of England)

“Plans now need to be in place to transition from Libor to alternative reference rates by end 2021. With 18 months to go these plans must now be acted upon in the time remaining.” – by Andrew Baily (Governor, Bank of England)

How will COVID-19 impact Brexit? (Bruegel)

“Talks have been delayed, the negotiators themselves have been sick and policymakers have needed to give their full attention to fighting the virus. Nevertheless, the U.K. continues to insist it will not ask for or accept an extension in June, the current deadline for establishing such measures. As a result, European politics is back to its […]

March 2020 UK Monetary Policy Summary (Bank of England)

“The Government has announced a series of substantial fiscal support measures to alleviate some of the severe cashflow problems facing businesses and households. The Bank of England also has a role to play in supporting businesses and households through the economic disruption associated with Covid-19.”

UK Budget 2020

“The Budget takes place against the backdrop of the global outbreak of COVID-19. The fundamentals of the UK economy are strong and the government is well prepared to protect people’s health and support their economic security throughout this period of temporary economic disruption. The Budget sets out a plan to support public services, individuals and […]

UK government urged to create new onshore fund structure for real assets (IPE)

“The UK government is being urged to fill a gap in its domestic investment management industry by creating a new onshore fund structure for real estate and infrastructure investors.” – by Richard Lowe